We know that the economy, at the macro level, is feeling strain as more people apply for unemployment, businesses shutter, and local governments are struggling to provide the necessary resources citizens need to carry on with their lives.

But what about individuals? What is their sentiment toward their own finances right now? These are the questions most of our partners are asking. Of course the answer is largely dependent on age, occupation and socioeconomic status, but we’re here to provide some resources that can help marketers make decisions now and look into the near future.

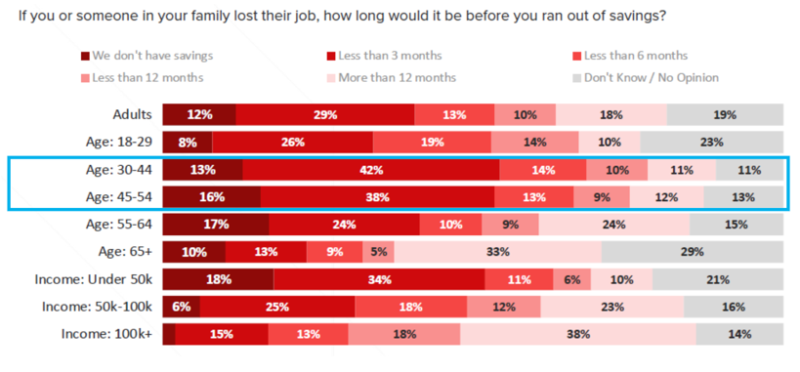

According to Morning Consult, 41% of people say they don’t have enough savings to last them more than 3 months if they lost their job. This is especially true for the older Millennial and GenX age group. This makes sense considering the life stage many of those people are in – children still living at home, possibly caring for an older parent and still in early stages of a mortgage.

Image Source: Morning Consult

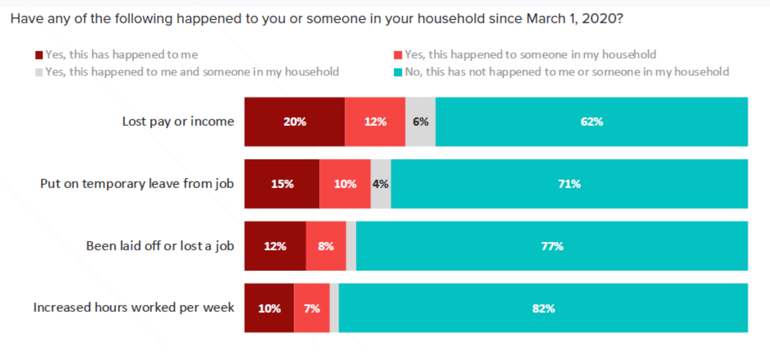

Additionally, the same survey reports that one-third of people have lost pay or income since March 1.

Image Source: Morning Consult

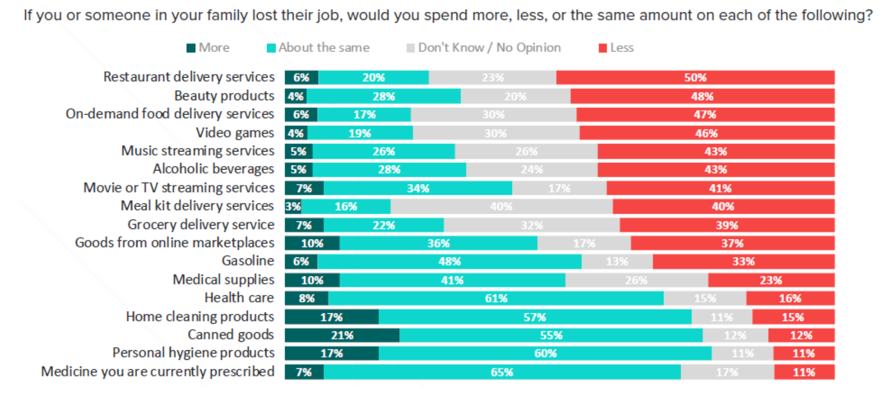

All of this begs the question, how are people managing their changing finances? First, of course, there are the cutbacks. There’s not really any surprises that the first things to go are what are seen as “everyday luxuries” like eating at restaurants, buying beauty products and apparel, and the convenience add-ons like grocery delivery and meal kits.

Image Source: Morning Consult

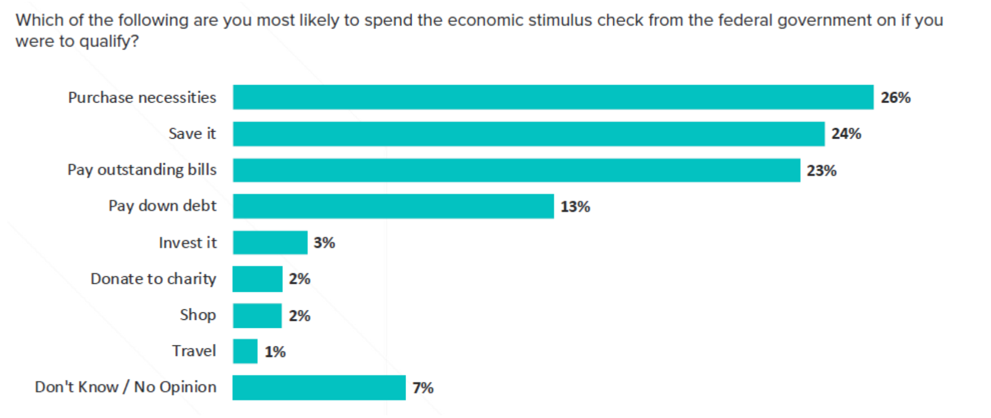

Some businesses may feel optimistic as Americans are set to receive a stimulus check soon. We see below how consumers are reporting they plan to spend that money (if they plan to spend it at all).

Image Source: Morning Consult

As you’ll see, about a quarter of people plan on saving some, if not all, of their stimulus check. There are likely a lot of reasons people are choosing this route, but anxieties are high right now around finances, and the decision to save is an emotional one. This is a great opportunity for financial services providers to get their message in front of new customers.

What does this mean for the “non-essential” businesses?

We talk to our partners often about what their needs are, and more importantly, their challenges. This is probably the biggest challenge many of them have ever faced in over a decade. Much of what you’re able to do depends on the type of business you are.

- Restaurants are pivoting to carry-out and delivery messaging in their promotions. Keeping consistent communications to your social and marketing database is key. Additionally, many are even starting to selll grocery items with takeout orders as a way to increase order size.

- With many people being stuck in their homes meaning many are noticing the improvements that need to be made, Home Improvement Services are shoring up their work for the future by focusing on qualified lead generating campaigns using targeted digital media.

- Entertainment Venues are promoting virtual events to stay in front of their audience and pushing gift card purchases to usher them through this time as events are canceled.

- The Travel Industry is focusing on booking now for 2021, generating revenue for future travel. Additionally, those that are able are turning to campaigns that are designed to build a more robust marketing database.

- Retail stores are pushing ecommerce purchases as home delivery is still an option.

What strains is your business feeling? We would love to hear from you and brainstorm ideas to help.